Are you wondering whether the current real estate market is going to crash like we saw in 2007-2009? Well, you’re not alone. This past month, “When is the housing marketing going to crash” was Google Search’s #1 search– asked 2450% more than any other question!

Many potential Buyers are gun shy from 2006. Can your Realtor® answer the question of if the real estate market is going crash for you?

Is the Real Estate Market Going to Crash?

According to Dr. Lawrence Yun, Chief Economist for the National Association of Realtors, the answer is a resounding NO! He explains a few reasons as to why he believes the real estate market will not crash.

Price Surges Amid the Pandemic

Over the past 12-15 months during and after the pandemic, we’ve seen a price surge in the real estate market, and it’s definitely been a a positive surprise. This market is unique in respect to a shortened inventory and the current economic environment.

New Economic Circumstances

Just like Covid introduced many unique factors, the Economy is also facing many new circumstances. The dollar value of goods produced/services provided is back to 100% but the job market has not recovered as well. Currently, 48 states are lower in job market conditions compared to pre covid.

What this means is that workers are doing more work than before, and job openings are at a record high. There are help wanted signs everywhere. Inflation is at its’ highest in many years. Core inflation (does not include food or volatile energy prices (gas)) is rising at the highest pace in 30 years.

This environment makes Real Estate -a fixed asset with a fixed payment -one of the greatest hedges against inflation – creating more demand than ever!

When Will Housing Costs Go Down?

Dr. Yun believes that housing costs are going to continue to increase. Rents prices will also increase making it harder to save for a down payment. Current homeowners with fixed 30-year payments are golden and able to utilize their position to manage a stable budget.

His forecast for the rest of 2021 is that we will finish 2021 with the highest sales since 2006, $6.1 million forecasted. He says sales are approaching pre pandemic levels meaning we are past the surge. Remember, we only had about 10 selling months in 2020 due to shutdowns, whereas we have 12 months in 2021.

New Inventory on the Market

The next 6 months will be a little better. We are past the absolute lowest inventory. There will be some homeowners who lost jobs during the pandemic and find themselves unable to pay their mortgages.

Programs to help them have run out. We hope and pray many of them will find jobs but those that do not will be able to sell their homes in a favorable market unlike the foreclosures seen 14 years ago. This will bring new inventory to the market.

What Makes the Housing Market Different Now Than From 2006?

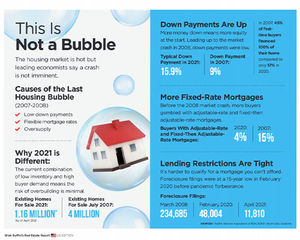

Today there are $1.2 million homes on the market – 4x more than there were during the crash.

We do not have the shady, risky mortgages that we saw back then. Owners with 30 yr. fixed rates are immune to upcoming policy changes by the Federal Reserve regarding lending.

Graphic below shared with permission from Brian Buffini of Brian Buffini and Company.

Sellers are Not in the Vulnerable Position of Foreclosure

Brian Buffini, Owner of the largest Real Estate Coaching and Training company in North America for over 25 years now, explains, “Bubbles do happen with runaway price increases, lower down payments and adjustable-rate mortgages. However, this time although prices are rising, people are putting more money down and getting fixed rate mortgages resulting in more equity in their homes. More equity equals a more stable dynamic.”

Considering prices for homes have increased an overage of 20%, could prices decline? Absolutely. Will the prices continue to keep declining? Brian Buffini says, “Absolutely not.” He says there is an army of willing and able buyers ready to buy immediately if prices start to decline. If there is a temporary price decline, it will only create a 2nd chance opportunity for buyers who have been outbid recently.

Other reasons people will continue to buy include:

- High Rental price increase make people want to buy (demand)

- No huge rate increases or relatively low rates.

- Pent up demand to move – older generation put off moving during in Covid – now are ready as there is less of a health risk putting homes on the market. This may also create a little more inventory.

- People are moving from high to lower tax states (more acute to tax differential in states)

Both Dr. Lawrence Yun and Brian Buffini predict 2022 will see slightly less increase but it will still be a big year for Real Estate!

Still have questions? Ask your 828 Realtor®!